There is a tool that is pretty much synchronized well by traders and investors in Stock Market Trading, Technical Analysis. The Golden Cross is one of the most important and commonly used trends in technical analysis. This is a pattern of bullish trend reversal that traders and analysts alike watch as it can be useful in predicting widespread market moves. Learn the ins and outs of Golden Cross, what it means to you as a trader where to find good stock runners.

What is a Golden Cross?

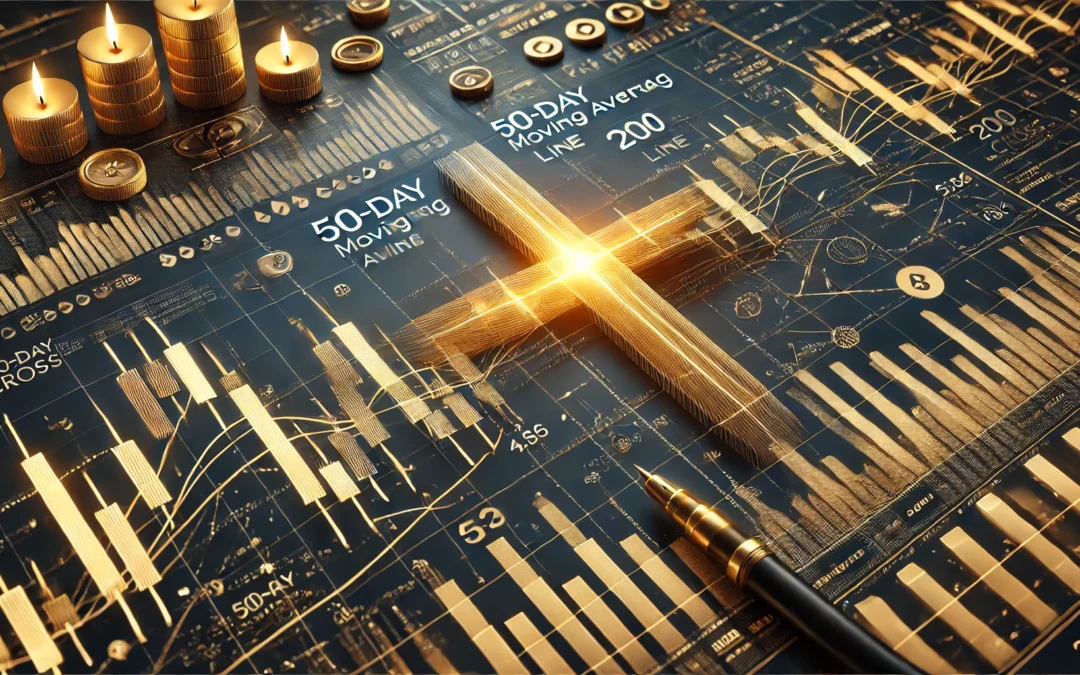

Golden Cross: When a short-term moving average crosses above of long-term moving average This is usually the 50-day moving average (MA) and/or the 200-day MA. A death cross typically potentially calls for moving from a bearish to bullish market trend (The inverse also applies). This pattern indicates that the most recent price movements are significant enough to eclipse longer-term trends and in favor of an uptrend, which lends more credence towards a bullish trend possibly starting.

The Golden Cross Forming

In the case of Golden Cross, it can be divided into any 3 unique stages given as:-

The Market is in a Downtrend and the short term moving average line crosses below the long-term liquidity easing.

Suddenly, the short-term moving average starts to rise and crosses over with long term-moving-average – Crossing Point The Golden Cross represents a bearish-to-bullish trend change, and this crossover point

Uptrend Confirmed: The short-term moving average remains above the long term bubble smoothing line, confirming a bullish trend. In this Phase, the long-term moving average frequently functions as a support level during market pullbacks ).

The Importance of the Golden Cross

This is a signal that the market thinks may lead to large rallies: GOLDEN CROSS. Which is a lagging indicator because it validates the trend that already started but does not predict what will happen. But, it shows strength in confirming a bullish move is sustainable. Before, while the S&P 500 was headed higher following Golden Crosses on a lurching melt-up, there have not been some significant gains in stock market history.

Example and Past Performance

In July 2020, during the recovery from the COVID-19 market crash, a Golden Cross appeared on the S&P 500. With the formation of a Golden Cross, we decided to create an index and this built up selective buys followed by series of rallies that saw the index climb almost from 3,185 to nearly touching 4.800 levels in January-2022.JSON Query Language This highlights how the Golden Cross can provide significant long-term upwards market movements pointing in this direction.

Golden Cross Metatrader 4 Forex RobotTrading Strategies

There are a number of strategies that traders use to benefit from the Golden Cross pattern.

Confirmation-Based Entry: Once the Golden Cross is confirmed, traders could look to go long and ride the uptrend.

Using with Other Indicators: As always, individual indications are not enough to create actionable forecasts so traders often combine the assessment of these behavioral changes by combining Moving Averages with other technical indicators like RSI or MACD.

Death Cross: This is the reverse of Golden cross where the 50MA line crossed by 200 MA in a downhill manner, it gives an indication to get out on long positions as we may expect the Bearish trend.

Limitations, Caveats and Reservations

The Golden Cross is a strong signal, although it can certainly still lead you astray. It will also act as a lagging indicator and may not always produce timely entries / exits. Also, when the markets are not trending and volatile, Golden Cross too can generate fake signals that if not used in combination with other indicators may lead to losses. Interpreting the Golden Cross, traders will also want to consider where prices are trading within the broader market context and underlying economic conditions.

Also Read: Amicharts Indian Stock and Commodity Market Intraday Trading Investment

Conclusion

To this day the Golden Cross is among one of the most respected patterns in technical analysis. When reached it can provide great insights into market trends and a potential bullish reversal. When a trader knows how it is structured, why and their use in trade strategies they can handle the intricacies of this market and benefit from the opportunity that arises. Just like all trading strategies, it is crucial to blend Golden Cross with other tools and have a risk management in place.